UPS to cut jobs and expand layoffs for cost saving measures

UPS to cut 12,000 jobs, explore options for Liquidation/Sales of Subsidiaries

UPS Inc. is currently considering strategic alternatives for its truckload brokerage business, Coyote Logistics, which may include a potential sale. This decision is part of UPS\'s broader initiative, \"Fit to Serve,\" aimed at restructuring its operations. The company acquired Coyote Logistics in 2015 for $1.8 billion, aiming to expand its portfolio. However, UPS later realized the cyclical nature of Coyote\'s business, which has exhibited significant volatility in recent years.

Originally, when UPS acquired Coyote, it was generating around $2 billion in annual revenue. This figure nearly doubled during the pandemic, but since then, there has been a notable drop in revenue. Like many in the freight brokerage sector, Coyote has faced challenges with slowing demand and plummeting rates, leading to several rounds of layoffs since early 2023.

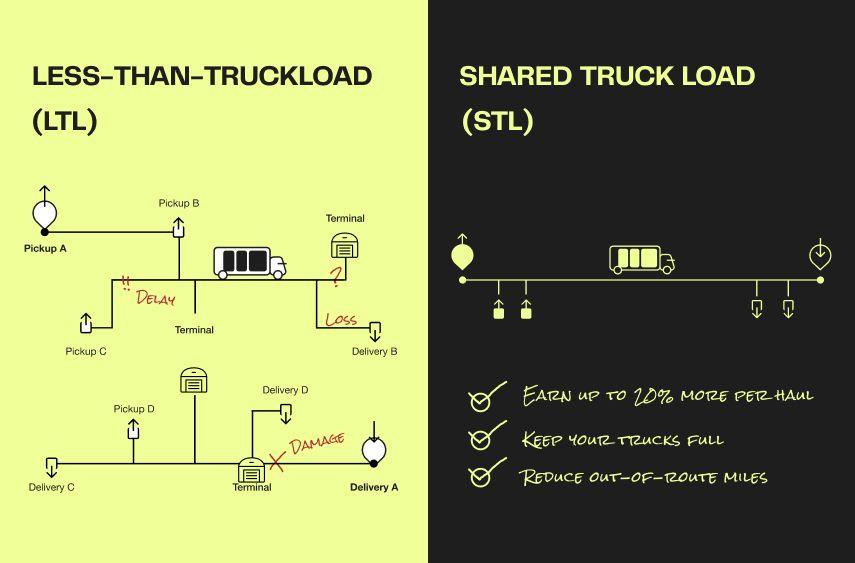

The transportation industry is known for its cyclical nature, and Coyote\'s fluctuating top and bottom lines have been a concern for UPS management. This situation is somewhat reminiscent of UPS\'s sale of its less-than-truckload business, UPS Freight, which was acquired by TFI International Inc. for $800 million and rebranded as T-Force Freight. The sale was motivated by similar reasons, as UPS Freight also presented a cyclical nature that didn\'t align with UPS\'s strategic direction under CEO Carol Tomé.

In addition to exploring options for Coyote Logistics, UPS has announced plans to cut approximately 12,000 full- and part-time management and contract jobs in 2024, representing less than 3% of its workforce. These layoffs are expected to contribute to a projected saving of about $1 billion for the company. The majority of these layoffs are slated to occur in the first half of the year, and they will not affect unionized employees.

For the year ahead, UPS anticipates facing challenges, particularly in the first half, but expects revenue and margins to stabilize as the year progresses. The company projects 2024 revenue to be between $92 billion and $94.5 billion, slightly up from $91 billion in 2023. However, operating margins are expected to decline compared to the previous year.

Sources: WSJ, Freightwaves, Yahoo Finance.

Key Topics Covered

Written by

Rapid Relay Team

The Rapid Relay team brings together industry expertise in freight optimization, relay operations, and supply chain innovation. Our writers share insights drawn from years of working with carriers and understanding the complexities of long-haul logistics.